Jeffery Nitz

35 Most Powerful Candlestick Patterns

Unlock the power of price action with these 35 most powerful candlestick patterns.

Master market entries, exits, and trend reversals with precision and confidence

Remember That Moment You First Knew You Wanted to Master Price Action?

That spark—that “aha” moment—wasn’t just curiosity. It was your instinct telling you that charts aren’t just lines and candles… they’re a language. And like any language, once you understand how to read it, everything changes.

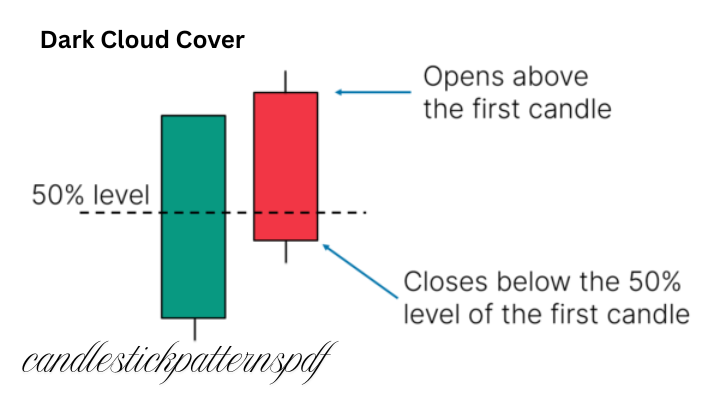

This is your opportunity to master that language through 35 of the most powerful candlestick patterns used by top traders worldwide. These aren’t just shapes on a chart — they’re precise signals that reveal the market’s intentions before the move happens. Whether you’re trading forex, stocks, or crypto, understanding these patterns will give you an edge that indicators alone can’t.

Mastering Candlestick Patterns Could Be Your Golden Ticket to a New Life as a Confident Trader.

With the right knowledge and 35 powerful candlestick patterns in your arsenal, you’re not just reading charts—you’re predicting moves, seizing opportunities, and stepping into the world of pro-level trading.

What are Candlestick Patterns in Trading?

Candlesticks are visual tools used in trading charts to show the price movement of an asset (like a stock, cryptocurrency, or currency pair) over a specific time period. Each candlestick represents one unit of time—such as 1 minute, 1 hour, 1 day, or 1 week—and shows four key prices

Part I: Bullish Candlesticks Pattern

Part II: Bearish Patterns

Part III: Popular CandleStick Pattern

Traders Who Took This Course

Traders who have completed this course report a dramatic improvement in their ability to read and interpret market movements.By mastering the 35 powerful candlestick patterns taught, they’ve gained clarity and confidence in identifying key price action signals that were once confusing.

Join The Movement To

Unlock Your Potential

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

320+ Happy Students

Lorem ipsum dolor sit amet, consectetur.

20 years of experience!

Lorem ipsum dolor sit amet, consectetur.

30+ winning awards

Lorem ipsum dolor sit amet, consectetur.

This program is

for you if…

This program is NOT

for you if…

Writers Already Using This Program

Are Making Tremendous Progress…

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod

tempor incididunt ut labore et dolore magna aliqua. Neque volutpat ac

tincidunt vitae semper quis lectus nulla at.

$149/m

Storytelling Course

for 12 Months

$149/m

Storytelling Course

for 12 Months

100% Money Back Guarantee.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis.

Popular questions

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod

tempor incididunt ut labore et dolore magna aliqua.