The Complete Guide to Gravestone Doji: Mastering This Powerful Reversal Pattern

Introduction

In the fast-paced world of technical analysis, candlestick patterns serve as crucial tools for traders seeking to decode market sentiment and predict future price movements. Among these patterns, the gravestone doji stands out as one of the most significant reversal indicators, offering traders valuable insights into potential market turning points.

This comprehensive guide will explore everything you need to know about the gravestone doji pattern, from its formation and interpretation to practical trading strategies and limitations. Whether you’re a beginner trader or an experienced market participant, understanding this pattern can significantly enhance your technical analysis toolkit.

What Is a Gravestone Doji?

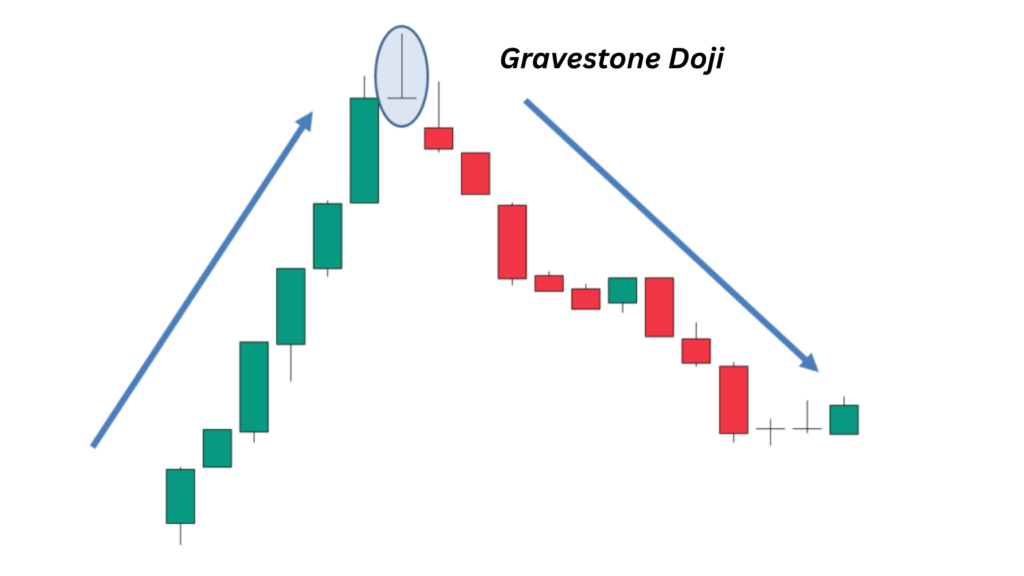

A gravestone doji is a distinctive candlestick pattern that forms when a security’s opening, closing, and low prices are all virtually identical, while the high price creates a long upper shadow or wick. The resulting candlestick resembles an inverted “T” or, as its name suggests, a gravestone marker.

Key Characteristics of a Gravestone Doji:

Visual Structure: The pattern consists of a small or non-existent body with a long upper shadow and little to no lower shadow. The opening and closing prices occur at or very near the session’s low point.

Market Context: This pattern typically appears after an uptrend, serving as a potential bearish reversal signal. The long upper shadow represents rejected higher prices, indicating that buyers attempted to push prices up but ultimately failed to maintain those levels.

Time Frame Flexibility: Gravestone dojis can appear on any time frame, from intraday charts to weekly or monthly candles, though their significance may vary depending on the context and volume.

What Does a Gravestone Doji Tell You?

The gravestone doji provides valuable insights into market psychology and the ongoing battle between bulls and bears. When this pattern emerges, it tells a compelling story about the trading session’s dynamics.

Buyer Exhaustion: The pattern suggests that buyers initially showed strength by driving prices higher during the session. However, their inability to maintain these elevated levels indicates potential exhaustion or weakening demand.

Seller Intervention: The long upper shadow demonstrates that sellers stepped in aggressively when prices reached higher levels, successfully pushing the price back down to near the opening level.

Indecision and Uncertainty: Like all doji patterns, the gravestone doji represents market indecision. The fact that prices closed near where they opened, despite significant intraday movement, suggests uncertainty about future direction.

Reversal Potential: When appearing after a sustained uptrend, the gravestone doji can signal that the prevailing bullish momentum may be losing steam, potentially leading to a trend reversal or at least a significant pullback.

Volume Confirmation: The reliability of the signal increases when accompanied by higher than average trading volume, confirming that the price rejection was meaningful rather than due to low liquidity.

Trading the Gravestone Doji

Successfully trading the gravestone doji requires understanding proper entry techniques, risk management, and confirmation signals. Here’s a comprehensive approach to incorporating this pattern into your trading strategy.

Entry Strategy

Wait for Confirmation: Never trade solely based on the gravestone doji appearance. Wait for the next candlestick to confirm the bearish bias by opening lower or showing continued selling pressure.

Entry Point Options: Consider entering short positions when the price breaks below the low of the gravestone doji candle, or wait for a break below a significant support level that follows the pattern.

Multiple Time Frame Analysis: Confirm the pattern’s validity by checking higher time frames. A gravestone doji on a daily chart carries more weight when supported by weekly chart analysis.

Risk Management

Stop Loss Placement: Place stop losses above the high of the gravestone doji candle. This level represents the point where the bearish thesis would be invalidated.

Position Sizing: Use appropriate position sizing based on the distance to your stop loss. The long upper shadow of gravestone dojis can create wider stop losses, requiring careful position management.

Risk-Reward Ratio: Aim for risk-reward ratios of at least 1:2 or better, measuring potential profit targets against the distance to your stop loss.

Confirmation Signals

Volume Analysis: Look for increased volume on the gravestone doji day, followed by continued high volume on subsequent bearish days.

Support and Resistance: The pattern gains significance when it forms near key resistance levels or previous highs.

Technical Indicators: Use momentum oscillators like RSI or MACD to confirm overbought conditions when the gravestone doji appears.

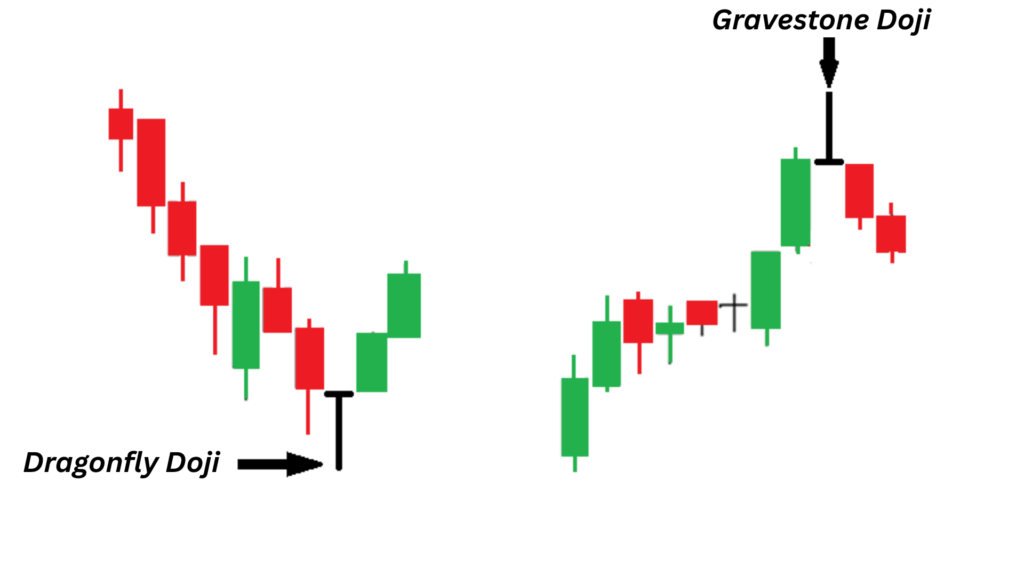

Gravestone Doji vs. Dragonfly Doji

Understanding the differences between gravestone and dragonfly dojis is crucial for proper pattern recognition and interpretation.

Structural Differences

Gravestone Doji: Features a long upper shadow with opening, closing, and low prices clustered at the bottom of the candle’s range.

Dragonfly Doji: Displays a long lower shadow with opening, closing, and high prices grouped at the top of the candle’s range.

Market Implications

Gravestone Doji Implications: Typically bearish when appearing after uptrends, suggesting seller dominance and potential reversal.

Dragonfly Doji Implications: Generally bullish when found after downtrends, indicating buyer support and possible upward reversal.

Trading Context

Trend Position: Gravestone dojis are most significant at market tops, while dragonfly dojis gain importance at market bottoms.

Volume Patterns: Both patterns benefit from volume confirmation, but the interpretation differs based on the prevailing trend direction.

Limitations of a Gravestone Doji

While the gravestone doji is a valuable technical pattern, traders must understand its limitations to avoid common pitfalls and false signals.

False Signal Risk

Market Context Dependency: The pattern’s reliability heavily depends on market context. A gravestone doji in a strong uptrend may represent only a temporary pause rather than a reversal.

Low Volume Concerns: Patterns forming on low volume may lack the conviction needed for meaningful price movements, leading to failed signals.

Time Frame Variations: Patterns appearing on shorter time frames are generally less reliable than those on daily or weekly charts.

Confirmation Requirements

Single Candle Limitation: Relying solely on one candlestick pattern without additional confirmation can lead to premature entries and losses.

Market Environment: The pattern may perform differently in trending versus ranging markets, requiring adaptive interpretation.

External Factors: News events, earnings announcements, or economic data can override technical patterns, making them temporarily irrelevant.

Practical Challenges

Identification Difficulty: Perfect gravestone dojis are relatively rare, and traders often must make subjective judgments about whether a pattern qualifies.

Timing Issues: Even valid patterns may take time to play out, testing trader patience and risk management skills.

Frequently Asked Questions

What Does Gravestone Doji Mean?

A gravestone doji is a candlestick pattern that signals potential bearish reversal in financial markets. The pattern forms when the opening, closing, and low prices are nearly identical, while the high price creates a long upper shadow. This formation suggests that buyers initially pushed prices higher during the trading session but were ultimately overpowered by sellers, who drove the price back down to near the opening level.

The name “gravestone” comes from the pattern’s visual resemblance to a tombstone or grave marker, with the long upper shadow representing the vertical stone and the small body at the bottom representing the base. This imagery reinforces the pattern’s bearish implications, suggesting the “death” of the current uptrend.

How Do You Trade on a Gravestone Doji?

Trading a gravestone doji effectively requires a systematic approach that combines pattern recognition with proper risk management. First, identify the pattern after an established uptrend, ensuring it has the characteristic long upper shadow and small body near the session’s low.

Wait for confirmation before entering any positions. This confirmation typically comes in the form of the next candlestick opening lower or showing continued bearish pressure. Consider entering short positions when the price breaks below the low of the gravestone doji candle, using this level as your reference point.

Place stop losses above the high of the gravestone doji, as a move above this level would invalidate the bearish signal. Set realistic profit targets based on nearby support levels or use a favorable risk-reward ratio of at least 1:2. Always consider the broader market context and use additional technical indicators to strengthen your analysis.

What Does a Gravestone Doji Indicate?

A gravestone doji indicates several important market conditions and potential future movements. Primarily, it suggests that buyers are losing control and that seller pressure is increasing. The pattern reveals market indecision at a critical juncture, typically after a sustained upward movement.

The long upper shadow demonstrates that while buyers managed to push prices significantly higher during the session, they couldn’t maintain those levels. This failure to hold higher prices often indicates weakening bullish momentum and the potential for a trend reversal or significant pullback.

When appearing at key resistance levels or after extended uptrends, the gravestone doji can signal an excellent opportunity for bears to take control. However, the pattern should always be considered within the broader market context and combined with other technical analysis tools for the most reliable signals.

What’s the Opposite of a Gravestone Doji?

The opposite of a gravestone doji is the dragonfly doji. While the gravestone doji features a long upper shadow with the opening, closing, and low prices clustered at the bottom, the dragonfly doji displays a long lower shadow with the opening, closing, and high prices grouped at the top of the candle’s range.

The dragonfly doji typically appears after downtrends and suggests potential bullish reversal, opposite to the gravestone doji’s bearish implications. The long lower shadow in a dragonfly doji indicates that sellers initially drove prices significantly lower during the session, but buyers stepped in to push prices back up to near the opening level.

Both patterns represent market indecision and potential reversal points, but their implications are opposite based on their structure and the prevailing trend context. Understanding both patterns allows traders to identify potential reversal opportunities in both bull and bear markets.

The Bottom Line

The gravestone doji represents a powerful tool in the technical analyst’s arsenal, offering valuable insights into market psychology and potential trend reversals. When properly identified and confirmed, this pattern can provide excellent trading opportunities for those looking to capitalize on bearish reversals after uptrends.

Success with gravestone doji patterns requires patience, proper risk management, and a thorough understanding of market context. Remember that no single pattern should be traded in isolation – always seek confirmation from additional technical indicators, volume analysis, and broader market trends.

The key to profiting from gravestone dojis lies in waiting for proper confirmation, managing risk effectively, and maintaining realistic expectations about the pattern’s reliability. While not every gravestone doji will lead to a significant reversal, those that do can provide substantial profit opportunities for prepared traders.

As with all technical analysis tools, continuous education and practice are essential for mastering the gravestone doji. Study historical examples, paper trade potential setups, and gradually incorporate the pattern into your broader trading strategy as you gain confidence and experience.

Trade on the Go. Anywhere, Anytime

Modern trading demands flexibility and accessibility, which is why having the right mobile trading platform is crucial for capitalizing on gravestone doji patterns and other technical opportunities. Today’s advanced trading apps provide comprehensive charting tools, real-time market data, and instant order execution capabilities that allow you to identify and act on patterns wherever you are.

Whether you’re commuting to work, traveling, or simply away from your desktop setup, mobile trading platforms ensure you never miss a potential gravestone doji setup. Look for apps that offer multiple time frame analysis, customizable alerts, and robust risk management tools to support your pattern-based trading strategy.

The ability to monitor markets and execute trades on mobile devices has revolutionized how traders approach technical analysis. With proper preparation and the right tools, you can successfully identify and trade gravestone doji patterns from virtually anywhere, ensuring that market opportunities don’t pass you by due to location constraints.