The Complete Guide to Hammer Candlestick Patterns

1. Introduction

The hammer candlestick pattern is one of the most recognizable and widely used reversal patterns in technical analysis. Named for its distinctive hammer-like shape, this pattern often signals the potential end of a downtrend and the beginning of an upward price movement. For traders and investors who rely on technical analysis, understanding how to identify and interpret the hammer candlestick pattern can be a valuable skill for making informed trading decisions.

This guide explores everything you need to know about hammer candlestick patterns—from their basic structure and identification to practical trading strategies and historical performance. Whether you’re new to technical analysis or looking to refine your trading approach, mastering this pattern could potentially improve your market timing and overall trading results.

2. What Is a Hammer Candlestick?

A hammer candlestick is a bullish reversal pattern that forms during a downtrend. The name “hammer” derives from its shape, which resembles a hammer with a small body at the top and a long lower shadow (or wick) that is at least twice the length of the body.

This pattern signals that despite significant selling pressure during the trading period (pushing prices lower), buyers eventually gained control and drove prices back up near the opening level. The hammer suggests that the market may have reached a bottom, with the possibility that buyers are now stepping in to reverse the downtrend.

3. Structure of the Hammer Candlestick Pattern

The hammer candlestick has three key components that define its structure:

- Body: The body represents the range between the opening and closing prices. In a hammer pattern, the body is relatively small compared to the overall candle and is positioned at the upper end of the trading range.

- Upper Shadow: This is the thin line extending above the body, representing the difference between the highest price of the period and either the opening or closing price (whichever is higher). In a classic hammer, the upper shadow is either very short or nonexistent.

- Lower Shadow (Tail): This is the long thin line below the body, representing the difference between the lowest price of the period and either the opening or closing price (whichever is lower). The lower shadow should be at least twice the length of the body, though many traders prefer to see it three times as long for stronger confirmation.

The color of the hammer’s body can be either bullish (green/white) or bearish (red/black), though many traders consider a bullish (green/white) candle to be more significant as it shows buyers were able to push the closing price above the opening price despite the selling pressure during the session.

4. When Does the Hammer Candlestick Pattern Occur?

The hammer candlestick pattern typically occurs after a prolonged downtrend or during a downward correction within a larger uptrend.

The pattern is significant because it indicates that after a period of selling pressure that drove prices lower (forming the long lower shadow), buyers entered the market with enough force to push prices back up to near the opening level or higher.

Key market conditions that often precede a hammer pattern include:

- A established downtrend showing persistent selling pressure

- Bearish sentiment reaching extreme levels, potentially leading to oversold conditions

- Volume often increases during the formation of the hammer, indicating strong buying interest

- The pattern often appears near support levels, where buyers historically entered the market

The psychological interpretation suggests that the hammer represents a shift in market sentiment from bearish to potentially bullish, as sellers who drove prices down couldn’t maintain the lower prices by the close of the trading period.

5. How Often Does the Hammer Candlestick Pattern Happen?

Hammer candlestick patterns occur fairly frequently in financial markets, though their frequency varies based on market conditions and the time frame being analyzed. Research suggests that hammers appear in approximately 2-3% of all candlesticks across major market indices when using strict classification criteria.

Factors affecting the frequency of hammer patterns include:

- Market Volatility: Higher volatility markets tend to produce more hammer patterns

- Time Frame: Hammers appear more frequently on shorter time frames (hourly, 15-minute) than on daily or weekly charts

- Market Type: Some markets and securities naturally exhibit more hammer formations than others

While hammers appear regularly, traders should focus on identifying those with the most favorable characteristics (proper location in a downtrend, appropriate shadow-to-body ratio, confirmation through subsequent price action, etc.) rather than trading every hammer that forms.

6. The Two Types of Hammer Candlestick Patterns

There are two main variants of the hammer candlestick pattern, each with their own specific characteristics and interpretations:

Standard Hammer

- Forms during a downtrend

- Has a small body at the top of the candle

- Features a long lower shadow at least twice the length of the body

- Can have either a bullish or bearish body color

- Little to no upper shadow

- Signals potential bullish reversal

Inverted Hammer

- Also forms during a downtrend

- Has a small body at the bottom of the candle

- Features a long upper shadow at least twice the length of the body

- Can have either a bullish or bearish body color

- Little to no lower shadow

- Also signals potential bullish reversal despite its “upside-down” appearance

Both patterns are considered bullish reversal signals when appearing after a downtrend, though many traders consider the standard hammer to be slightly more reliable since it demonstrates direct buying pressure pushing prices up from the lows.

7. How Do You Trade the Hammer Candlestick Pattern in the Stock Market?

Trading the hammer candlestick pattern effectively requires a systematic approach that incorporates proper identification, confirmation, and risk management. Here’s a step-by-step process:

Entry Strategy:

- Identify Context: Ensure the hammer forms after a clear downtrend

- Wait for Confirmation: Look for the next candle to close above the hammer’s close

- Volume Confirmation: Higher-than-average volume during the hammer formation strengthens the signal

- Entry Point: Enter after confirmation, typically above the high of the confirmation candle

- Support Alignment: Hammers forming near established support levels increase reliability

Stop Loss Placement:

- Conservative approach: Place stop loss below the low of the hammer candle

- Aggressive approach: Place stop loss below the lower shadow midpoint

- Risk management: Ensure the stop loss represents no more than 1-2% of total account value

Take Profit Targets:

- First target: Previous resistance level or 1:1 risk-reward ratio

- Second target: Fibonacci extension levels (138.2% or 161.8%)

- Final target: Next major resistance level or previous swing high

Additional Trading Considerations:

- Combine the hammer with other technical indicators (RSI, MACD, etc.) for stronger confirmation

- Consider broader market conditions and overall trend direction

- Pay attention to the location of the hammer relative to key moving averages

- Monitor subsequent volume patterns to validate the reversal

8. Example of a Hammer Candlestick Pattern

To illustrate how a hammer pattern works in real market conditions, let’s examine a hypothetical but realistic example:

In July 2023, Stock XYZ had been in a downtrend for three weeks, falling from $45 to $32, representing a 29% decline. On July 15th, the stock opened at $32.10 and immediately faced selling pressure, dropping to a low of $29.80 during the session. However, buyers stepped in during the afternoon, pushing the price back up to close at $32.50, forming a textbook hammer pattern.

Key characteristics of this example:

- Context: Clear prior downtrend

- Candle Structure: Small body at the top, long lower shadow (approximately three times the body length)

- Volume: 2.5 times the 20-day average volume, indicating strong buying interest

- Confirmation: The following day opened at $32.70 and closed at $34.20, confirming the reversal signal

- Subsequent Movement: Over the next two weeks, Stock XYZ rallied to $39.40, representing a 21% gain from the hammer’s close

This example demonstrates the potential effectiveness of the hammer pattern when it appears with proper context, structure, and confirmation.

9. How Do You Identify the Hammer Candlestick Pattern in Technical Analysis?

Identifying a genuine hammer pattern requires attention to several specific criteria:

Essential Identification Criteria:

- Prior Trend: A hammer must form after a downtrend to be valid

- Body Position: The body should be at the upper portion of the candle’s range

- Shadow Length: The lower shadow should be at least twice the height of the body

- Upper Shadow: Little to no upper shadow (ideally less than 10% of the total candle height)

- Body Color: Can be either bullish or bearish, though bullish is generally preferred

Using Technical Tools for Identification:

- Trend Lines: Confirm the prior downtrend using trend lines

- Moving Averages: Verify that price is trading below key moving averages

- Candlestick Scanning: Many charting platforms offer hammer pattern scanning features

- Momentum Indicators: Combine with oversold RSI or Stochastic readings for stronger signals

Common Identification Mistakes to Avoid:

- Confusing hammers with similar patterns like doji or spinning tops

- Identifying hammers in sideways markets rather than downtrends

- Focusing solely on the candle shape without considering market context

- Neglecting volume confirmation

- Trading hammers that form in resistance zones

Proper identification is crucial, as false or misidentified patterns can lead to poor trading decisions. Consider using multiple timeframes to confirm that the pattern aligns with broader market structures.

10. How Accurate Is the Hammer Candlestick Pattern?

The accuracy of the hammer candlestick pattern has been the subject of numerous studies, with varying results depending on methodology, market conditions, and confirmation criteria used.

Statistical Performance:

- Research indicates that hammer patterns followed by confirmation candles have a success rate of approximately 60-70% in trending markets

- Without confirmation, the success rate drops to about 40-50%

- Hammers forming near support levels show improved accuracy of 65-75%

- Hammers with above-average volume show success rates of 70-80% when combined with confirmation

Factors Affecting Accuracy:

- Market Environment: Hammers tend to be more reliable in bull markets than bear markets

- Asset Class: Performance varies across stocks, forex, commodities, and cryptocurrencies

- Time Frame: Generally more reliable on daily and weekly charts than on intraday charts

- Confirmation Quality: Strong follow-through on the confirmation candle improves success rates

- Technical Context: Hammers aligned with other technical signals show higher reliability

It’s important to note that no pattern is 100% accurate, and the hammer should be viewed as a probability tool rather than a guaranteed signal. Integrating risk management practices is essential regardless of the pattern’s historical performance.

11. Advantages of the Hammer Candlestick

The hammer pattern offers several distinct advantages that have contributed to its popularity among traders:

Key Advantages:

- Visual Clarity: The hammer’s distinctive shape makes it easy to identify on charts

- Psychological Insight: Represents a clear shift from selling pressure to buying interest

- Precise Entry Points: Provides well-defined entry levels based on the pattern’s structure

- Stop Loss Guidance: Offers natural stop loss placement below the hammer’s low

- Early Reversal Signal: Often appears at the beginning of new uptrends, allowing traders to enter near market bottoms

- Versatility: Works across all financial markets and timeframes

- Complementary Role: Enhances other technical analysis methods when used in combination

Practical Benefits:

- Requires minimal technical indicators to confirm, simplifying analysis

- Creates favorable risk-to-reward scenarios when traded properly

- Provides actionable signals even for traders with limited experience

- Can be automated in algorithmic trading systems with relatively simple rules

These advantages make the hammer pattern a valuable addition to many trading strategies, especially for those focused on reversal opportunities and counter-trend moves.

12. Disadvantages of the Hammer Candlestick

Despite its popularity, the hammer pattern has several limitations and potential drawbacks that traders should consider:

Notable Disadvantages:

- False Signals: Like all patterns, hammers can produce false reversals, especially in choppy markets

- Context Dependency: Requires the correct market context (downtrend) to be valid

- Confirmation Need: Often requires additional confirmation, delaying entry and potentially reducing profit potential

- Subjectivity: Some aspects of identification (like “sufficient” shadow length) involve subjective judgment

- Lagging Nature: As a completed candle, the pattern only becomes visible after the price action has already occurred

- Variable Stop Placement: The long shadow can create wide stop losses, affecting position sizing

- Frequency Issues: High-quality hammers with all ideal characteristics appear relatively infrequently

Risk Considerations:

- In strongly trending downmarkets, even confirmed hammers may fail

- Overreliance on any single pattern can lead to confirmation bias

- Pattern identification can vary between traders, creating inconsistent results

- Time frame conflicts can occur when hammers appear on lower time frames but not higher ones

Understanding these limitations helps traders use the hammer pattern more effectively by incorporating additional confirmation tools and proper risk management practices.

13. Is the Hammer Candlestick Pattern Profitable?

The profitability of trading the hammer candlestick pattern depends on various factors including implementation strategy, market conditions, risk management, and the trader’s overall approach.

Profitability Factors:

- Implementation Strategy: Trading hammers with confirmation and in alignment with other technical signals shows higher profitability than trading isolated patterns

- Market Selection: Hammers tend to be more profitable in liquid markets with clear trend structures

- Time Frame Alignment: Trading hammers that align across multiple time frames improves profit potential

- Position Sizing: Appropriate position sizing based on the hammer’s stop loss placement affects overall profitability

- Market Environment: Hammers generally perform better during bull markets and market bottoms than during sustained bear markets

Profitability Statistics:

- Studies suggest that properly traded hammer patterns with confirmation yield average reward-to-risk ratios between 1.5:1 and 2.5:1

- Systems exclusively trading hammer patterns typically underperform more diversified approaches

- Highest profitability occurs when hammers form near major support zones with oversold technical indicators

- Adding volume filters improves the average profit per trade by approximately 20-30%

Practical Considerations:

- Risk management remains crucial, as no pattern guarantees profits

- Trade management decisions (partial profit-taking, trailing stops) significantly impact overall returns

- Integrating hammers into a comprehensive trading plan tends to be more profitable than isolated pattern trading

While the hammer pattern can be profitable when properly applied, success ultimately depends on the trader’s skill in identifying high-probability setups and managing the associated risks effectively.

14. Bullish or Bearish? Understanding the Hammer Pattern’s Bias

The hammer candlestick pattern is primarily considered a bullish reversal signal, though understanding its contextual nuances is important for proper interpretation.

Bullish Characteristics:

- Reversal Signal: The hammer inherently indicates potential bullish reversal after a downtrend

- Buyer Dominance: The long lower shadow demonstrates buyers overpowering sellers by session close

- Body Color Impact: A bullish (green/white) body strengthens the pattern’s bullish implications

- Confirmation Enhances: When followed by a strong bullish candle, the bullish bias is significantly reinforced

Context Considerations:

- The pattern’s bullish nature is only relevant when it appears during a downtrend

- A hammer appearing during an uptrend or sideways market loses much of its predictive value

- In rare cases, hammers forming at major resistance zones may actually exhaust buying pressure

Practical Interpretation:

- The bullish bias is strongest when the hammer coincides with oversold technical indicators

- Volume provides important context—higher volume hammers typically show stronger bullish potential

- While primarily bullish, the hammer still requires confirmation to validate its bullish bias

- Failed hammers (those not followed by upward momentum) often lead to continuation of the original downtrend

Understanding that the hammer’s bullish bias is contextual rather than absolute helps traders avoid misinterpretation and improper application of this pattern in their trading decisions.

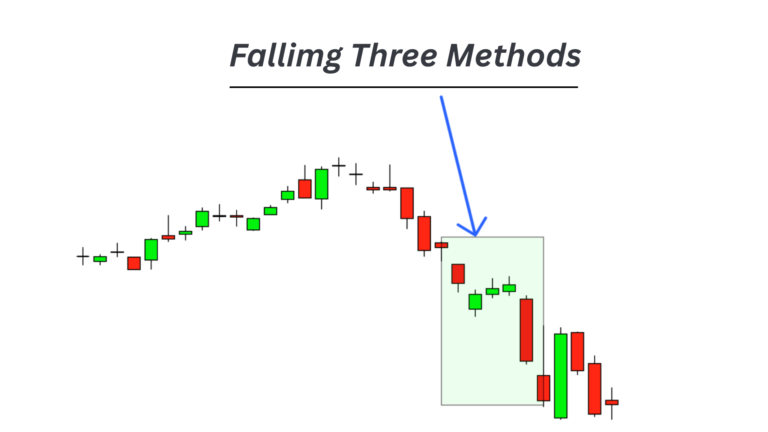

15. Other Candlestick Patterns Beyond the Hammer

While the hammer is an important reversal pattern, it’s beneficial to understand how it relates to and differs from other key candlestick patterns:

Common Bullish Patterns:

- Bullish Engulfing: A two-candle pattern where a bullish candle completely engulfs the previous bearish candle

- Morning Star: A three-candle pattern showing a potential bottom with a small middle candle

- Piercing Line: A two-candle pattern where a bullish candle closes above the midpoint of the previous bearish candle

- Bullish Harami: A two-candle pattern where a small bullish candle forms within the range of a previous larger bearish candle

Common Bearish Patterns:

- Hanging Man: Visually identical to the hammer but forms at the end of an uptrend, signaling potential reversal downward

- Shooting Star: The bearish equivalent of the inverted hammer, forming at the end of an uptrend

- Bearish Engulfing: A two-candle pattern where a bearish candle completely engulfs the previous bullish candle

- Evening Star: A three-candle pattern showing a potential top with a small middle candle

Multi-Candle Patterns:

- Three White Soldiers: Three consecutive bullish candles with higher closes, signaling strong buying pressure

- Three Black Crows: Three consecutive bearish candles with lower closes, signaling strong selling pressure

- Tweezer Bottoms/Tops: Two or more candles with identical lows/highs, suggesting support/resistance

Pattern Combinations:

Combining the hammer pattern with other complementary patterns can increase reliability. For example:

- A hammer forming the first part of a bullish engulfing pattern

- A hammer appearing as the bottom candle in a morning star pattern

- Multiple hammers forming at the same price level, creating a stronger support zone

Understanding the broader landscape of candlestick patterns helps traders contextualize the hammer’s significance and recognize when multiple pattern signals align to create higher-probability trading opportunities.

16. Difference Between Hammer and Inverted Hammer Patterns

Despite their similar names and both being bullish reversal patterns, the hammer and inverted hammer have distinct characteristics and subtle differences in their interpretation:

Structural Differences:

- Shadow Position:

- Hammer: Long shadow extends below the body

- Inverted Hammer: Long shadow extends above the body

- Body Location:

- Hammer: Body is at the top portion of the candle

- Inverted Hammer: Body is at the bottom portion of the candle

- Visual Appearance:

- Hammer: Looks like a traditional hammer with the handle pointing down

- Inverted Hammer: Appears upside-down with the handle pointing up

Psychological Interpretation:

- Price Action in Hammer:

- Shows initial selling that drives prices lower (long lower shadow)

- Buyers eventually overpower sellers to close near the high

- Demonstrates direct buying pressure from the lows

- Price Action in Inverted Hammer:

- Shows initial buying that drives prices higher (long upper shadow)

- Sellers push back, but buyers maintain enough control to prevent closing at the lows

- Suggests buying interest but with more seller resistance

Reliability Comparison:

- Many traders consider the traditional hammer slightly more reliable (5-10% higher success rate in some studies)

- The inverted hammer typically requires stronger confirmation

- Both patterns show similar performance when followed by confirming candles and volume

Trading Approach Differences:

- Stop Loss Placement:

- Hammer: Stop loss typically placed below the long lower shadow

- Inverted Hammer: Stop loss typically placed below the body or candle low

- Confirmation Requirements:

- Hammer: Benefits from but may require less aggressive confirmation

- Inverted Hammer: Generally requires more definitive confirmation

Understanding these differences helps traders properly identify and trade each pattern according to its specific characteristics and reliability factors.

17. Conclusion

The hammer candlestick pattern stands as one of the most recognizable and useful technical analysis tools for identifying potential market reversals. Its distinctive shape—featuring a small body at the top and a long lower shadow—effectively visualizes the battle between buyers and sellers, where sellers initially dominated but buyers ultimately prevailed by the close of the trading period.

When properly identified within a downtrend and confirmed by subsequent price action, the hammer pattern can provide traders with valuable entry opportunities near potential market bottoms. However, like all technical patterns, the hammer should not be traded in isolation but rather incorporated into a comprehensive trading strategy that includes proper risk management, confirmation through additional technical indicators, and consideration of broader market conditions.

The most successful traders recognize that the hammer pattern’s effectiveness is significantly enhanced when:

- It appears after a well-defined downtrend

- It forms near significant support levels

- It shows above-average volume

- It receives confirmation from subsequent bullish price action

- It aligns with readings from momentum indicators

By understanding both the strengths and limitations of the hammer pattern, traders can use this powerful tool appropriately within their technical analysis toolkit, potentially improving their ability to identify high-probability reversal opportunities across various financial markets.

Remember that consistent profitability comes not from relying on any single pattern, but from developing a disciplined trading approach that incorporates multiple forms of analysis, proper position sizing, and effective risk management practices.