The Rising and Falling Three Methods Candlestick Pattern: A Complete Trading Guide

Introduction

In the world of technical analysis, candlestick patterns serve as powerful tools for traders seeking to decode market sentiment and predict future price movements. Among the many patterns that have stood the test of time, the Rising and Falling Three Methods patterns hold a special place as reliable continuation indicators. These patterns, rooted in centuries-old Japanese trading wisdom, offer traders valuable insights into market psychology and potential trend persistence.

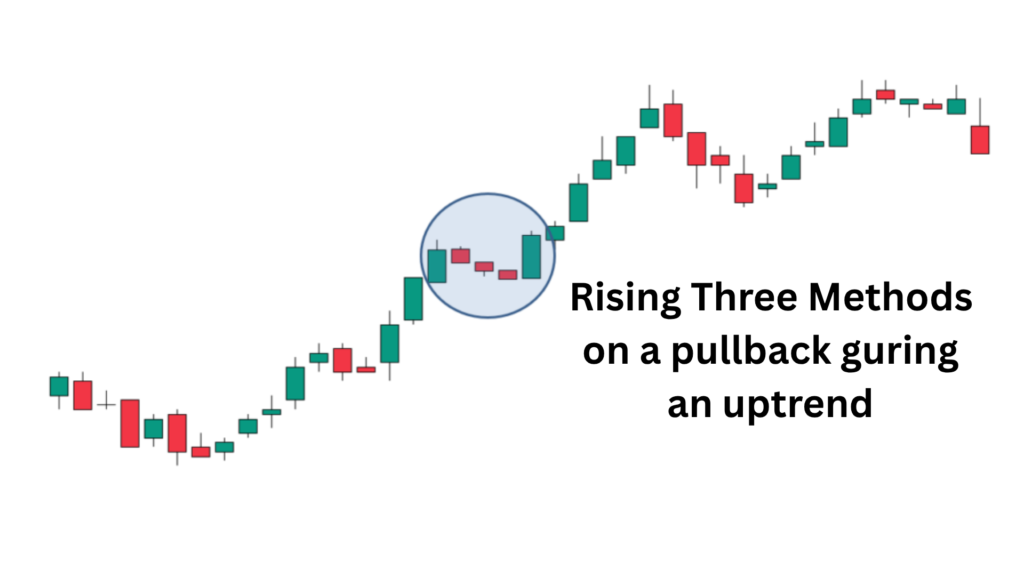

The Three Methods patterns are particularly noteworthy because they represent periods of consolidation within established trends, providing traders with opportunities to enter positions in the direction of the prevailing market momentum. Understanding these patterns can significantly enhance your trading arsenal, whether you’re a day trader looking for short-term opportunities or a swing trader focusing on longer-term trends.

What is the Rising and Falling Three Methods Candlestick Pattern?

The Rising and Falling Three Methods are five-candle continuation patterns that signal the likely resumption of an existing trend after a brief consolidation period. These patterns belong to the family of Japanese candlestick formations and are considered among the more reliable continuation patterns in technical analysis.

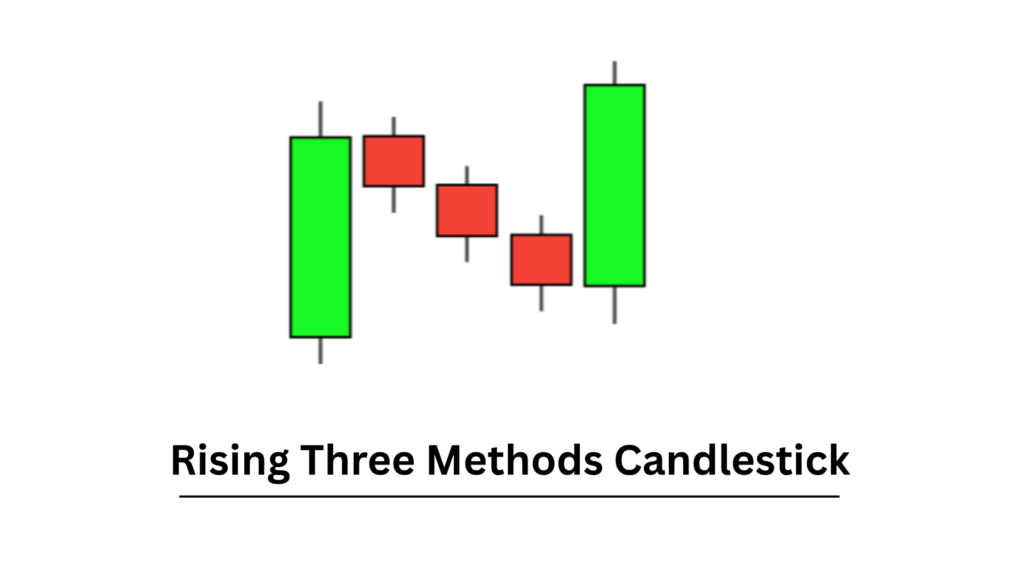

The Rising Three Methods Pattern occurs during an uptrend and consists of:

- A long bullish (green/white) candle

- Three consecutive small-bodied candles that trade within the range of the first candle

- A final long bullish candle that closes above the high of the first candle

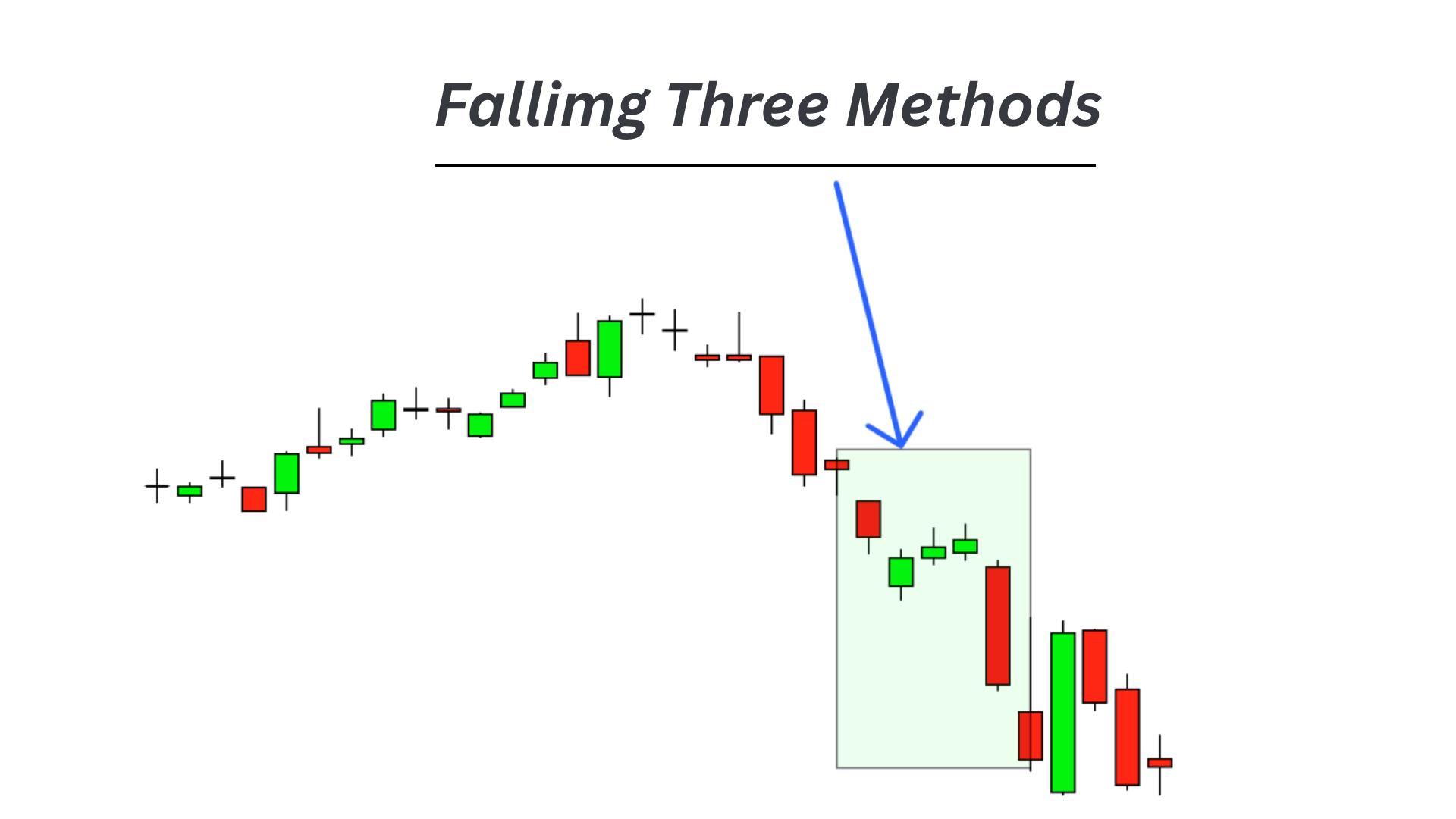

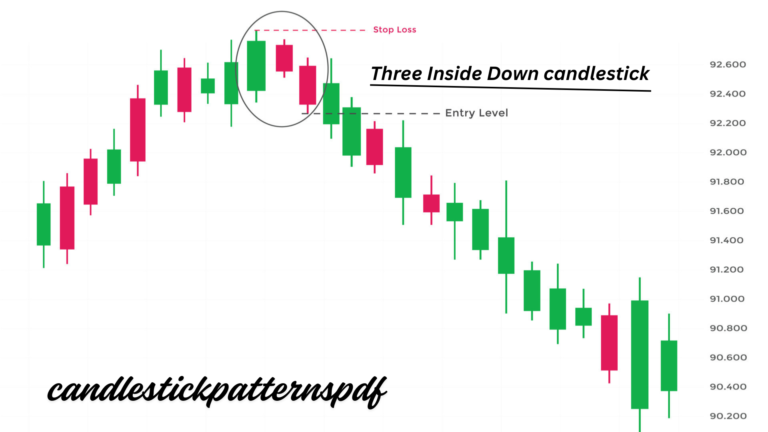

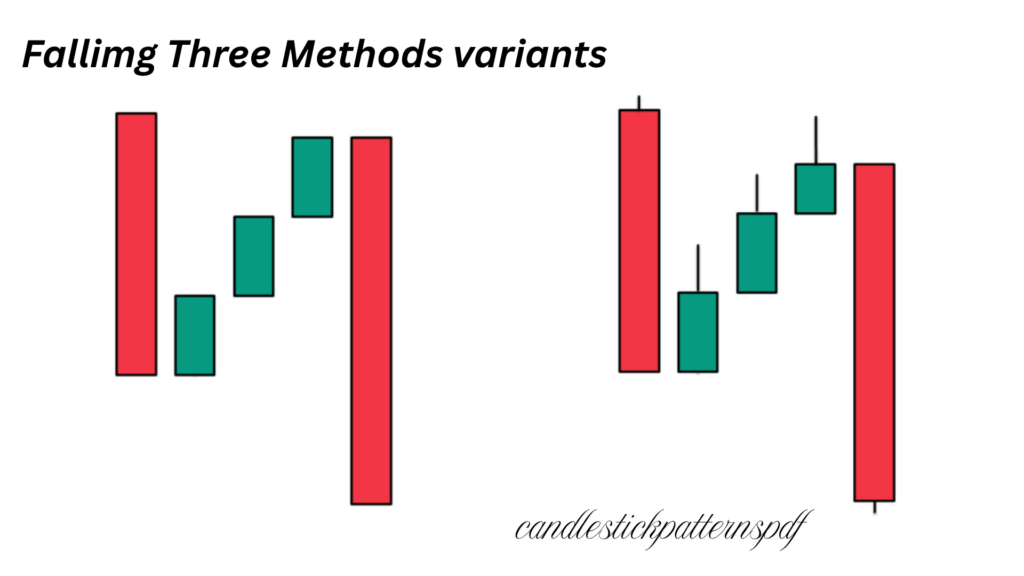

The Falling Three Methods Pattern occurs during a downtrend and consists of:

- A long bearish (red/black) candle

- Three consecutive small-bodied candles that trade within the range of the first candle

- A final long bearish candle that closes below the low of the first candle

These patterns typically unfold over five trading sessions, though the middle three candles can sometimes extend to four or five small candles while maintaining the same interpretation.

What is the Meaning Behind the Rising and Falling Three Methods Patterns?

The psychological dynamics behind these patterns reveal fascinating insights into market behavior and trader sentiment. The name “Three Methods” originates from ancient Japanese trading philosophy, referring to three different approaches or “methods” that traders might employ during the consolidation phase.

In the Rising Three Methods, the initial long bullish candle demonstrates strong buying pressure and upward momentum. The subsequent three small candles represent a period where neither bulls nor bears can gain decisive control – bulls are taking profits while bears attempt to push prices lower, but neither side dominates. This consolidation period is healthy for the trend as it allows the market to “digest” recent gains without significant selling pressure. The final bullish candle confirms that buyers have regained control and are ready to push prices higher.

For the Falling Three Methods, the initial bearish candle shows strong selling pressure. The three small candles that follow represent a temporary pause in selling, possibly due to short covering or bargain hunting. However, the lack of significant buying interest during this consolidation suggests that the downward pressure remains intact. The final bearish candle confirms that sellers are back in control.

These patterns essentially represent a “rest” period within a trending market, where the dominant force temporarily steps back before reasserting control.

How to Identify the Rising and Falling Three Methods Pattern in Trading

Proper identification of these patterns requires attention to specific criteria and market context. Here are the key elements to look for:

Market Context Requirements

Before considering these patterns, ensure you’re in a clearly established trend. The Rising Three Methods should appear during an uptrend, while the Falling Three Methods should occur during a downtrend. The strength and duration of the preceding trend will influence the pattern’s reliability.

Volume Considerations

Volume plays a crucial role in validating these patterns. Ideally, you should observe:

- Higher volume on the first long candle

- Decreasing volume during the three consolidation candles

- Increased volume on the final confirming candle

This volume profile supports the interpretation that the initial move had conviction, the consolidation represented decreased interest, and the final move confirmed renewed participation.

Time Frame Analysis

These patterns work across multiple time frames, from intraday charts to weekly charts. However, patterns on higher time frames typically carry more weight and reliability. Consider the time frame in relation to your trading style and holding period.

Pattern Variations

While the classic pattern involves exactly three consolidation candles, variations with four or five small candles can still be valid. The key is that these candles remain within the range of the first candle and show relatively small bodies compared to the opening and closing candles.

Identify the Rising Three Methods Chart Pattern

The Rising Three Methods pattern requires systematic identification across five specific stages:

Stage 1: The Breakout Candle Look for a long bullish candle with a substantial body that closes significantly higher than it opened. This candle should ideally break above recent resistance levels or continue an existing upward move with conviction.

Stage 2-4: The Consolidation Phase The next three candles should exhibit the following characteristics:

- Small bodies relative to the first candle

- Highs that don’t exceed the high of the first candle

- Lows that don’t fall below the low of the first candle

- Can be bullish, bearish, or doji candles

- Should show declining volume compared to the first candle

Stage 5: The Confirmation Candle The final candle must:

- Be bullish with a substantial body

- Close above the high of the first candle

- Preferably show increased volume

- Demonstrate renewed upward momentum

Common Identification Mistakes

Traders often misidentify patterns by:

- Accepting patterns without proper trend context

- Ignoring volume confirmation

- Confusing three methods patterns with other consolidation formations

- Failing to wait for proper confirmation from the fifth candle

How to Trade the Rising and Falling Three Methods Pattern

Successfully trading these patterns requires a structured approach that encompasses entry timing, risk management, and profit-taking strategies.

Entry Strategies

Conservative Entry Approach: Wait for the completion of the fifth candle before entering. For Rising Three Methods, enter long after the fifth bullish candle closes above the high of the first candle. For Falling Three Methods, enter short after the fifth bearish candle closes below the low of the first candle.

Aggressive Entry Approach: Enter during the formation of the fifth candle if it shows strong momentum in the expected direction. This approach offers better risk-reward ratios but carries higher risk of false signals.

Stop Loss Placement

For Rising Three Methods:

- Conservative: Place stop loss below the low of the consolidation period

- Aggressive: Place stop loss below the low of the first candle

For Falling Three Methods:

- Conservative: Place stop loss above the high of the consolidation period

- Aggressive: Place stop loss above the high of the first candle

Profit Targets

Profit targets can be established using various methods:

Measured Move: Project the length of the first candle from the breakout point of the fifth candle.

Technical Levels: Target the next significant support or resistance level in the direction of the trend.

Risk-Reward Ratio: Aim for a minimum 2:1 risk-reward ratio to ensure profitable trading over time.

Additional Confirmation Indicators

Consider combining Three Methods patterns with:

- Moving average analysis to confirm trend direction

- RSI or other momentum indicators to assess overbought/oversold conditions

- Volume indicators to confirm participation

- Support and resistance levels for additional context

How Accurate Are the Rising and Falling Three Methods Patterns?

The accuracy of Three Methods patterns has been studied extensively, with success rates varying based on market conditions, time frames, and implementation methods.

Statistical Performance

Research suggests that properly identified Three Methods patterns have success rates ranging from 60% to 75% in trending markets. However, these statistics can vary significantly based on:

- Market Conditions: Patterns perform better in strong trending environments and may fail more frequently in choppy or sideways markets.

- Time Frame: Higher time frame patterns generally show better reliability than those on shorter time frames.

- Volume Confirmation: Patterns with proper volume confirmation show significantly higher success rates.

- Market Volatility: Performance may decrease during periods of extreme volatility or major news events.

Factors Affecting Accuracy

Market Environment: Bull and bear markets may favor different pattern outcomes. During strong trending periods, continuation patterns like the Three Methods tend to perform better.

Economic Context: Major economic announcements, earnings releases, or geopolitical events can override technical patterns.

Asset Class: Different markets (stocks, forex, commodities) may show varying success rates for the same patterns.

Improving Pattern Reliability

To enhance accuracy:

- Use multiple time frame analysis

- Combine with other technical indicators

- Consider fundamental factors

- Practice proper risk management

- Maintain detailed trading records for pattern performance tracking

The Rising and Falling Three Methods Pattern – Pros and Cons

Advantages

Clear Structure: The five-candle formation provides a well-defined pattern that’s relatively easy to identify once you understand the criteria.

Strong Psychological Foundation: The pattern reflects genuine market psychology, representing periods where the dominant trend temporarily pauses before resuming.

Versatile Application: Works across different time frames, asset classes, and market conditions, making it valuable for various trading styles.

Good Risk-Reward Potential: The pattern’s structure allows for logical stop-loss placement and reasonable profit targets.

Continuation Reliability: As continuation patterns, they align with the principle of “trend is your friend,” which has historically been profitable.

Volume Integration: The pattern naturally incorporates volume analysis, providing additional confirmation when present.

Disadvantages

Requires Trending Markets: The patterns are ineffective in sideways or choppy market conditions, limiting their application.

Time-Consuming Formation: The five-candle requirement means waiting for complete pattern development, which may result in missed opportunities.

False Signals: Like all technical patterns, Three Methods formations can fail, particularly in volatile market conditions or around major news events.

Subjective Interpretation: Determining what constitutes “small” consolidation candles versus the opening candle can be subjective.

Late Entry: Waiting for pattern completion often means entering trades after significant moves have already occurred.

Market Structure Changes: Algorithmic trading and changing market dynamics may affect the historical reliability of these patterns.

Risk Management Considerations

While trading these patterns, consider:

- Never risk more than 1-2% of your account on a single trade

- Use position sizing appropriate to your account and risk tolerance

- Be prepared to exit if market conditions change dramatically

- Monitor broader market sentiment and news that could impact your trades

Final Thoughts

The Rising and Falling Three Methods patterns represent valuable tools in the technical analyst’s toolkit, offering insights into market psychology and trend continuation probabilities. These time-tested formations, rooted in centuries of trading wisdom, continue to provide relevant signals in modern markets when properly applied.

Success with these patterns requires more than just pattern recognition. It demands understanding of market context, proper risk management, and the discipline to wait for high-probability setups. The patterns work best when combined with other forms of analysis and when traders maintain realistic expectations about their accuracy and limitations.

Remember that no trading pattern guarantees success, and the Three Methods patterns are no exception. They should be part of a comprehensive trading strategy that includes proper risk management, diversification, and continuous learning. The key to long-term success lies not in finding the perfect pattern, but in consistently applying sound trading principles while adapting to changing market conditions.

As you incorporate these patterns into your trading approach, maintain detailed records of your trades, continuously refine your identification skills, and always be prepared to adapt your strategy as markets evolve. The Three Methods patterns have survived centuries of market changes because they reflect fundamental aspects of human trading psychology – and that psychological foundation remains as relevant today as it was in ancient Japanese rice markets.

Whether you’re a novice trader learning technical analysis or an experienced trader looking to refine your pattern recognition skills, the Rising and Falling Three Methods patterns offer a structured approach to identifying trend continuation opportunities. With proper application, risk management, and realistic expectations, these patterns can become valuable components of a successful trading strategy.