The Rising Three Methods: A Complete Guide for Traders

1. Rising Three Methods: What It Is and How It Works

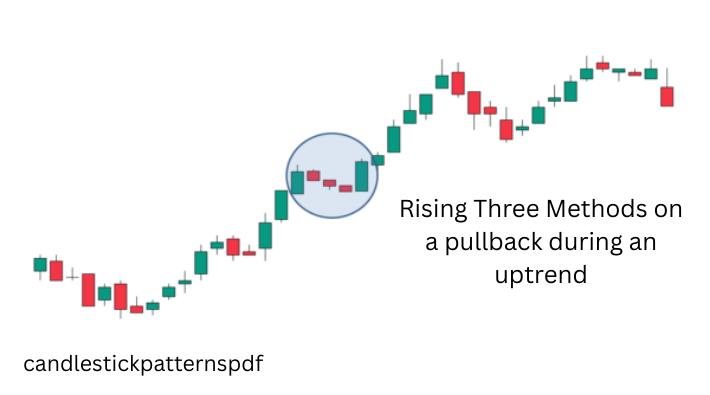

The Rising Three Methods is a bullish continuation candlestick pattern that signals a temporary pause in an uptrend before the price continues moving higher. This pattern is highly regarded among technical analysts and traders for its reliability and clear signal of market sentiment.

Originating from Japanese candlestick charting techniques, the Rising Three Methods consists of a specific sequence of five candlesticks. When properly identified, this pattern indicates that despite short-term profit-taking or consolidation, the overall bullish momentum remains intact, and prices are likely to continue their upward trajectory.

2. What Is the Rising Three Methods Pattern?

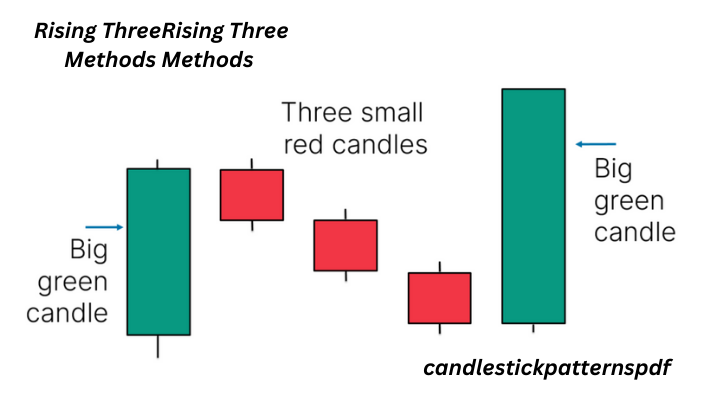

The Rising Three Methods is a five-candle formation that occurs within an established uptrend. The pattern consists of:

- A large bullish (green/white) candle that shows strong upward momentum

- Three small bearish (red/black) candles that stay within the range of the first candle

- A final large bullish candle that closes above the close of the first candle

This pattern illustrates a brief period of consolidation or profit-taking (represented by the three small bearish candles) within an ongoing uptrend, followed by a resumption of the bullish trend (confirmed by the final bullish candle).

3. Understanding the Rising Three Methods Pattern

The psychology behind the Rising Three Methods pattern provides insight into market dynamics:

- First bullish candle: Represents strong buying pressure and upward momentum in the market

- Three small bearish candles: Indicates temporary profit-taking or consolidation, but crucially, these candles remain within the range of the first candle, suggesting that bears aren’t strong enough to reverse the trend

- Final bullish candle: Confirms that bulls have regained control and the uptrend is resuming

This pattern essentially shows that while bears attempted to drive prices lower during the consolidation phase, they lacked the conviction to push prices below the low of the initial bullish candle. When bulls regain control, they push prices to new highs, indicating that the uptrend remains intact.

4. How Do You Spot a Rising Three Methods Pattern?

To identify a valid Rising Three Methods pattern, look for these specific characteristics:

- Existing uptrend: The pattern must occur within an established uptrend

- First candle: A large bullish candle with a significant body

- Three middle candles: Small bearish candles that remain within the high-low range of the first candle

- Final candle: A large bullish candle that closes above the close of the first candle

For the pattern to be valid, the three middle candles should ideally show decreasing volume, indicating diminishing selling pressure. Additionally, the three middle candles should not close below the low of the first candle, as this would suggest stronger bearish momentum than expected in a true Rising Three Methods pattern.

5. How Do You Identify a Falling Three Methods Pattern?

The Falling Three Methods is the bearish counterpart to the Rising Three Methods. It signals a temporary pause in a downtrend before prices continue moving lower. To identify this pattern, look for:v

- Existing downtrend: The pattern must occur within an established downtrend

- First candle: A large bearish candle with a significant body

- Three middle candles: Small bullish candles that remain within the high-low range of the first candle

- Final candle: A large bearish candle that closes below the close of the first candle

As with the Rising Three Methods, the three middle candles in the Falling Three Methods should show decreasing volume and remain within the range of the first candle, indicating that bulls lack the strength to reverse the overall downtrend.

6. What Does the Three Methods Pattern Tell You?

When properly identified, the Three Methods pattern (both Rising and Falling variants) provides several key insights:

- Trend continuation: The pattern confirms that the prevailing trend (up or down) is likely to continue

- Temporary consolidation: It indicates a brief period of consolidation or profit-taking before the trend resumes

- Strength assessment: The pattern helps assess the relative strength of bulls versus bears at a critical juncture

- Psychological insight: It reveals the market psychology, showing how buyers and sellers interact during a consolidation phase

Importantly, the Three Methods pattern is considered more reliable when it occurs at key support or resistance levels or coincides with other technical indicators, such as moving averages or volume patterns.

7. How to Trade the Rising Three Methods Pattern

Trading the Rising Three Methods pattern effectively requires a systematic approach:

Entry

The traditional entry point is immediately after the confirmation of the pattern, which occurs when the fifth candle closes above the close of the first candle. Some traders prefer to wait for additional confirmation, such as:

- A breakout above the high of the fifth candle

- Confirmation from technical indicators like RSI or MACD

- Increased volume on the breakout candle

Stop Loss and Risk Management

Risk management is crucial when trading any pattern. For the Rising Three Methods, typical stop-loss placements include:

- Below the low of the pattern (below the lowest point of the three middle candles)

- Below the low of the first candle

- Below a key support level near the pattern

The exact stop-loss placement depends on your risk tolerance and the volatility of the particular asset. Generally, a stop-loss of 1-2% of your account value is recommended to manage risk effectively.

Profit Targets

Setting realistic profit targets for the Rising Three Methods pattern can be done using several methods:

- Measured move: Calculate the distance from the bottom of the first candle to its close, then project this distance from the entry point

- Previous resistance levels: Use historical resistance levels as potential profit targets

- Fibonacci extensions: Apply Fibonacci extension levels from the low of the pattern to the high of the fifth candle

- Risk-reward ratio: Set a profit target that provides at least a 2:1 reward-to-risk ratio

Most traders use a combination of these methods to determine appropriate profit targets based on the specific market conditions and the asset being traded.

8. Conclusion

The Rising Three Methods pattern offers traders a valuable tool for identifying potential continuation opportunities within an uptrend. By understanding the pattern’s structure, psychology, and trading applications, traders can leverage this formation to make more informed decisions.

Remember that while the Rising Three Methods pattern has a high reliability rate, no pattern works 100% of the time. Always use it in conjunction with other technical analysis tools, fundamental analysis, and sound risk management principles. Additionally, practice identifying and trading this pattern in a demo account before applying it to live markets.

By mastering the Rising Three Methods and its bearish counterpart, the Falling Three Methods, traders add powerful weapons to their technical analysis arsenal, potentially enhancing their ability to identify and capitalize on trend continuation opportunities in various market conditions.