The Three Inside Up Candlestick Pattern: Definition, Analysis & Trading Strategies

Candlestick patterns remain one of the most powerful technical analysis tools for traders seeking to identify potential reversals and continuations in market trends. Among these formations, the Three Inside Up pattern stands out as a reliable bullish reversal signal that can help traders identify optimal entry points.

In this comprehensive guide, we’ll explore everything you need to know about the Three Inside Up pattern—from its definition and market implications to practical trading strategies for maximizing your success with this formation.

Three Inside Up Definition and Meaning

The Three Inside Up is a three-candlestick bullish reversal pattern that typically forms at the bottom of a downtrend. This pattern consists of:

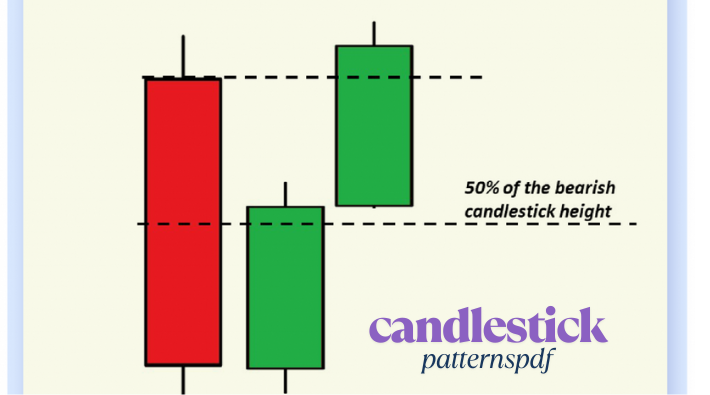

- First Candle: A long bearish (red/black) candle, indicating that sellers are still in control of the market.

- Second Candle: A small bullish (green/white) candle that opens and closes entirely within the body of the first candle (hence “inside”).

- Third Candle: A bullish candle that closes above the high of the second candle and ideally above the midpoint of the first candle’s body.

The Three Inside Up represents a gradual shift in market sentiment from bearish to bullish. The first candle shows selling pressure, the second suggests hesitation and a potential change in direction, and the third confirms that buyers are now taking control of the market.

What Does a Three Inside Up Tell Us About the Market?

When a Three Inside Up pattern appears, it provides several important insights about underlying market psychology:

- Exhaustion of Sellers: The appearance of the small bullish candle after a strong bearish candle indicates that selling pressure is weakening.

- Increase in Buying Interest: The third candle’s bullish close confirms that buyers are stepping in with greater conviction.

- Potential Trend Reversal: The pattern suggests that the previous downtrend may be losing momentum and a new uptrend could be forming.

- Shift in Sentiment: There’s a progressive shift from bearish to indecision to bullish sentiment over the three-day period.

This pattern is particularly significant when it appears near support levels, oversold conditions, or after extended downtrends, as these factors can enhance its reliability as a reversal signal.

Three Inside Up Example

Let’s examine a hypothetical example of the Three Inside Up pattern in action:

Imagine you’re analyzing the price chart of XYZ stock, which has been in a downtrend for several weeks. The stock closed at $50 yesterday after opening at $55, forming a strong bearish candle. Today, the stock opens at $51, trades within a narrow range, and closes at $52, forming a small bullish candle completely within the range of the previous day’s candle. On the third day, the stock opens at $51.50 and closes at $53.50, forming another bullish candle that closes above the high of the second day’s candle.

This sequence of candles forms a textbook Three Inside Up pattern, suggesting that the downtrend may be reversing and presenting a potential buying opportunity.

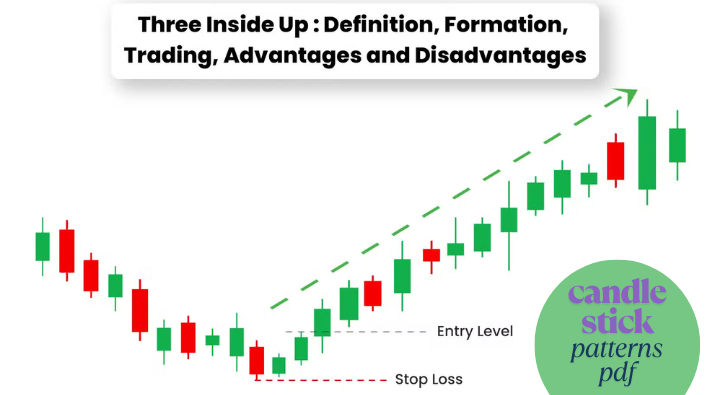

How to Trade the Three Inside Up

Successfully trading the Three Inside Up pattern requires a systematic approach:

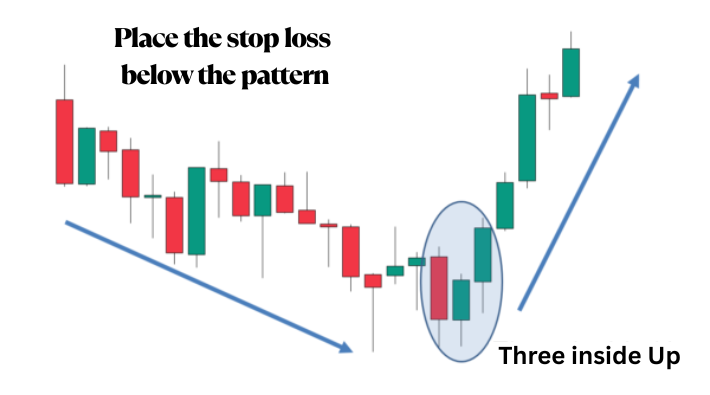

- Pattern Identification: Look for the specific three-candle sequence in a downtrend—a long bearish candle, a small bullish inside candle, and a bullish confirmation candle.

- Entry Point: The most common entry point is after the completion of the third candle, once the bullish reversal is confirmed. More conservative traders might wait for additional confirmation, such as a fourth bullish candle or a break above a key resistance level.

- Stop-Loss Placement: A logical place for your stop-loss is below the low of the pattern, typically beneath the first or second candle, depending on your risk tolerance.

- Profit Target: Set profit targets based on previous resistance levels, Fibonacci retracement levels, or a risk-reward ratio of at least 1:2.

- Risk Management: Limit your position size to ensure that your maximum loss on the trade aligns with your overall risk management strategy.

Three Inside Up Trading Strategies

Strategy 1: Three Inside Up with Volume Confirmation

Volume provides valuable insight into the strength behind price movements. This strategy enhances the reliability of the Three Inside Up pattern by incorporating volume analysis:

- Look for declining volume on the first bearish candle, suggesting that selling pressure may be weakening.

- Identify lighter volume on the second (inside) candle, indicating market indecision.

- Confirm with increasing volume on the third bullish candle, showing strong buying interest.

- Enter the trade only when all three volume conditions align with the candlestick pattern.

- Set your stop-loss below the low of the first candle.

- Target the next significant resistance level or use a trailing stop to capture potential trend continuation.

The addition of volume confirmation helps filter out false signals and increases the probability of successful trades.

Strategy 2: Three Inside Up and Breakout Distance

This strategy focuses on the strength of the breakout indicated by the third candle:

- Measure the body size of the third candle relative to the first candle.

- Calculate the breakout percentage (how far the close of the third candle is above the close of the second candle).

- Prioritize patterns where the third candle shows strong momentum, closing near its high and well above the midpoint of the first candle.

- Enter more aggressively when the breakout is strong, with larger position sizes for more convincing formations.

- Use a trailing stop that tightens as the new uptrend develops.

This approach helps you allocate more capital to higher-probability setups while limiting exposure to weaker patterns.

How Should I Trade the Three Inside Up Pattern?

To maximize your success with the Three Inside Up pattern, consider these best practices:

- Confirm with Other Indicators: Combine the pattern with other technical indicators such as RSI, MACD, or moving averages to filter out false signals and increase reliability.

- Consider Market Context: The pattern is more reliable when it forms near key support levels, at the bottom of a downtrend, or in oversold conditions.

- Be Patient with Entry: While entering after the third candle is standard, waiting for a fourth confirmatory candle or a pullback to a support level can improve your risk-reward ratio.

- Use Multiple Timeframes: Confirm the reversal signal on multiple timeframes for stronger conviction. For example, a daily Three Inside Up becomes more significant if the weekly chart also shows bullish divergence.

- Adapt to Market Conditions: In volatile markets, you may need wider stops and more conservative position sizing; in trending markets, you can be more aggressive with your targets.

How is the Three Inside Up Pattern Defined?

For precise identification of the Three Inside Up pattern, use these specific criteria:

- First Candle Requirements:

- Must be bearish (close lower than open)

- Should have a relatively large body compared to recent price action

- Should appear after a clear downtrend

- Second Candle Requirements:

- Must be bullish (close higher than open)

- Must open and close entirely within the body of the first candle

- The smaller the second candle relative to the first, the better

- Third Candle Requirements:

- Must be bullish (close higher than open)

- Must close above the close of the second candle

- Ideally closes above the midpoint of the first candle’s body

- The longer the third candle, the stronger the reversal signal

For optimal results, ensure that all three candles strictly adhere to these definitions, as variations may reduce the pattern’s reliability.

Conclusion

The Three Inside Up pattern offers traders a structured approach to identifying potential bullish reversals in downtrending markets. Its three-candle sequence provides clear entry signals, logical stop-loss levels, and a framework for managing risk. By combining this pattern with volume analysis, considering market context, and implementing sound risk management, you can effectively incorporate the Three Inside Up into your trading arsenal.

Remember that no pattern works 100% of the time, so always practice proper position sizing and risk management. Start by paper trading this pattern to gain confidence in its signals before committing real capital. With practice and discipline, the Three Inside Up can become a valuable tool in your technical analysis toolkit, helping you identify high-probability trading opportunities in various market conditions.

As with any trading strategy, continuous learning and adaptation are key to long-term success. Keep a trading journal to track your Three Inside Up trades, analyze your results, and refine your approach over time.