Three White Soldiers: A Powerful Bullish Reversal Pattern

Introduction

In the intricate world of technical analysis, candlestick patterns serve as visual roadmaps that can help traders navigate market sentiment and potential price movements. Among these patterns, the Three White Soldiers formation stands as one of the most compelling bullish reversal signals. Originating from Japanese rice trading centuries ago, this pattern continues to be a valuable tool for modern traders seeking to identify the potential end of downtrends and the beginning of new bullish momentum.

The Three White Soldiers pattern is respected across various markets for its strong psychological underpinnings and historical reliability. When properly identified and confirmed, it can provide traders with valuable insights into shifting market dynamics and potential trading opportunities. In this comprehensive guide, we’ll explore everything you need to know about this powerful pattern, from its identification to practical trading strategies and enhancement techniques.

What Do Three White Soldiers Mean?

The Three White Soldiers pattern is a bullish reversal candlestick formation that consists of three consecutive bullish (white or green) candles appearing after a downtrend. Each of these candlesticks has specific characteristics that, when combined, create a powerful signal of bullish momentum:

- First Soldier: A bullish candle that forms after a downtrend, showing the first sign of buying pressure.

- Second Soldier: Another bullish candle that opens within the body of the previous candle and closes higher than the first candle’s high.

- Third Soldier: A third bullish candle that opens within the body of the second candle and closes higher than the second candle’s high.

For a perfect Three White Soldiers pattern, each candle should:

- Open within the real body of the previous candle (not necessarily at the same price)

- Close near their highs (showing strong buying pressure throughout the period)

- Have relatively long bodies with short or no upper shadows (indicating buyers maintained control)

- Show progressively increasing volume (though this is not an absolute requirement)

The visual progression of these three bullish candles, each building upon the previous one’s gains, creates the appearance of an advancing army—hence the militaristic name “Three White Soldiers.”

What Do Three White Soldiers Tell You?

The Three White Soldiers pattern conveys several important messages to technical analysts and traders:

Strong Reversal Signal

When appearing after a downtrend, this pattern signals a decisive shift in market sentiment from bearish to bullish. The consecutive series of strong bullish candles indicates that buyers have overwhelmed sellers for three straight periods, suggesting the previous downtrend may have exhausted itself.

Sustained Buying Pressure

Unlike single-candle reversal patterns, the Three White Soldiers demonstrates persistent buying pressure over multiple periods. This sustained interest from buyers adds credibility to the reversal signal, suggesting the new bullish momentum may have staying power.

Psychological Shift

The pattern represents a psychological transformation in the market. After a period of pessimism (downtrend), traders are becoming increasingly optimistic about the asset’s prospects, as evidenced by the progressively higher closes and controlled opens.

Technical Strength

From a technical perspective, each soldier creates a new support level. With each candle closing higher than the previous one, the pattern establishes a series of higher lows and higher highs—the fundamental characteristic of an uptrend.

Potential Continuation

While primarily considered a reversal pattern, the Three White Soldiers can also suggest strong continuation when it appears during an established uptrend, especially after a brief retracement or consolidation period.

Example of How to Trade Three White Soldiers

Let’s explore a practical approach to trading the Three White Soldiers pattern:

Identification and Entry Strategy

- Pattern Recognition: Scan for three consecutive bullish candles where each opens within the previous candle’s body and closes higher than the previous candle’s high.

- Volume Confirmation: Check if volume increases with each candle, which would strengthen the signal.

- Entry Point: The most conservative entry is above the high of the third soldier, waiting for additional confirmation. More aggressive traders might enter at the open of the candle following the pattern.

- Stop-Loss Placement: Place a stop-loss below the low of the first soldier or, for more conservative protection, below the low of the third soldier.

Example Scenario

Imagine stock XYZ has been in a downtrend for several weeks, falling from $50 to $35. After reaching $35, the following price action occurs:

- Day 1: The stock opens at $35.20 and closes at $37.80, forming a strong bullish candle.

- Day 2: The stock opens at $37.40 (within the body of the first candle) and closes at $40.10.

- Day 3: The stock opens at $39.80 (within the body of the second candle) and closes at $42.30.

This forms a clear Three White Soldiers pattern. A trader might:

- Enter a long position at $42.50, just above the high of the third soldier.

- Set a stop-loss at $34.80, just below the low of the first soldier.

- Set a profit target at $50, the previous resistance level before the downtrend began.

Risk Management and Position Sizing

- Risk no more than 1-2% of trading capital on this position.

- Calculate position size based on the distance between entry and stop-loss.

- Consider scaling out of the position at multiple profit targets to secure gains while allowing for further upside.

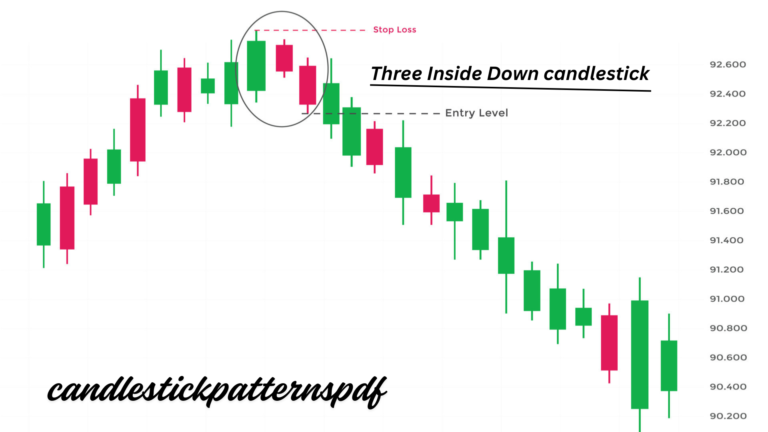

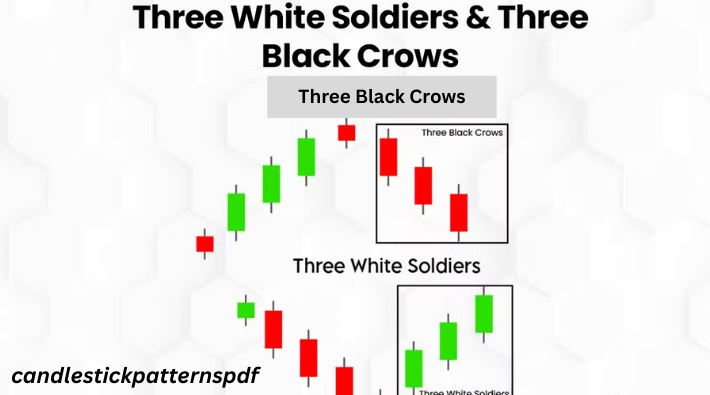

The Difference Between Three White Soldiers and Three Black Crows

The Three White Soldiers and Three Black Crows are mirror images of each other, representing opposite market conditions:

Three White Soldiers:

- Consists of three consecutive bullish candles

- Signals a potential bullish reversal or continuation

- Each candle opens within the previous candle’s body and closes higher

- Typically appears after a downtrend

- Indicates increasing buying pressure

Three Black Crows:

- Consists of three consecutive bearish candles

- Signals a potential bearish reversal or continuation

- Each candle opens within the previous candle’s body and closes lower

- Typically appears after an uptrend

- Indicates increasing selling pressure

Both patterns derive their strength from the persistent momentum displayed over three consecutive periods, showing a clear dominance of either buyers (White Soldiers) or sellers (Black Crows). They both suggest that the newly established direction could continue for some time as the market sentiment has decisively shifted.

Limitations of Using Three White Soldiers

Despite its strength as a reversal signal, the Three White Soldiers pattern has several limitations traders should be aware of:

Potential Overextension

Three consecutive strong bullish candles can push an asset into overbought territory, potentially setting up a short-term pullback. The RSI or stochastic oscillator often shows overbought readings after this pattern forms.

False Signals

Like all candlestick patterns, Three White Soldiers can produce false signals, especially in choppy or ranging markets where clear trends are lacking.

Subjectivity in Identification

There’s room for interpretation in what constitutes a valid pattern. How strictly should the opens be within the previous candle’s body? How long should the candles be? These subjective elements can lead to inconsistent identification.

Market Context Dependency

The pattern’s reliability varies significantly depending on the broader market context, including the strength of the preceding downtrend, current market volatility, and proximity to key support/resistance levels.

Timeframe Sensitivity

The pattern may generate different levels of reliability across various timeframes, generally being more significant on longer timeframes.

Need for Confirmation

Trading this pattern in isolation without confirming signals from other technical indicators or market factors can lead to poor trading decisions.

What Other Chart Patterns Are Similar to the Three White Soldiers?

Several chart patterns share similarities with Three White Soldiers, though each has its unique characteristics:

Bullish Engulfing Pattern

A two-candle reversal pattern where a bullish candle completely engulfs the previous bearish candle. While less powerful than Three White Soldiers, it often serves as the first signal of a potential reversal.

Morning Star

A three-candle bullish reversal pattern consisting of a large bearish candle, a small-bodied candle (star), and a large bullish candle. Unlike Three White Soldiers, the Morning Star includes a period of indecision (the star) before the bullish move.

Three Inside Up

A three-candle bullish reversal pattern starting with a large bearish candle, followed by a bullish candle that closes within the first candle’s body, and completed by a third bullish candle that closes above the high of the second candle.

Three Line Strike

A four-candle pattern where three consecutive bullish candles (similar to Three White Soldiers) are followed by a large bearish candle that engulfs all three previous candles.

White Marubozu Series

Multiple consecutive White Marubozu candles (bullish candles with no or minimal shadows) can resemble Three White Soldiers but typically have more strict requirements for little to no shadows.

What Can Be Done to Improve the Reliability of the Three White Soldiers Chart Pattern?

To enhance the effectiveness of the Three White Soldiers pattern, consider implementing these strategies:

Confluence with Support/Resistance Levels

The pattern generates stronger signals when it forms near significant support levels, Fibonacci retracement levels, or historical price points of interest.

Volume Confirmation

Look for progressively increasing volume across the three candles, confirming growing buying interest. Higher volume on the third soldier is particularly significant.

Trend Analysis

Assess the strength and duration of the preceding downtrend. The pattern tends to be more reliable after steep, extended downtrends that may have exhausted selling pressure.

Multiple Timeframe Analysis

Confirm the pattern across different timeframes. A Three White Soldiers appearing on both daily and weekly charts provides a stronger signal than one appearing on a single timeframe.

Technical Indicator Confirmation

Combine the pattern with technical indicators:

- Bullish divergence on RSI or MACD

- Moving average crossovers

- Support from longer-term moving averages

- Bullish readings on momentum indicators

Market Breadth Consideration

For stock trading, examine broader market conditions and sector performance. The pattern is more reliable when aligned with the general market direction.

Candle Quality Assessment

Evaluate the quality of each candle:

- Minimal upper shadows (indicating strong closes)

- Progressive size increase (showing building momentum)

- Clear open within the previous candle’s body

- Consistent color (no doji or indecision candles)

What Are the Best Assets to Trade with the Three White Soldiers Chart Pattern?

The Three White Soldiers pattern can be applied across various financial instruments, though its effectiveness may vary:

Stocks

Individual stocks often respond well to this pattern, particularly those with:

- Moderate to high liquidity

- Clear technical levels

- Strong fundamental backdrop

- Institutional interest

Mid to large-cap stocks tend to produce more reliable signals than small-caps or penny stocks.

Forex Pairs

Major currency pairs like EUR/USD, GBP/USD, and USD/JPY can exhibit reliable Three White Soldiers patterns, especially on the 4-hour and daily charts. The high liquidity and round-the-clock trading of forex markets can create cleaner technical patterns.

Cryptocurrencies

While volatile, major cryptocurrencies like Bitcoin and Ethereum can form powerful Three White Soldiers patterns, often leading to substantial moves. However, the higher volatility requires wider stops and careful risk management.

Commodities

Gold, silver, oil, and other major commodities tend to respond well to this pattern, particularly on daily and weekly charts where broader market sentiment is more clearly reflected.

Stock Indices

Major indices like the S&P 500, Dow Jones, and Nasdaq often form reliable Three White Soldiers patterns, especially after market corrections. These signals can be particularly valuable for trading index futures or ETFs.

What Is the Best Timeframe to Use the Three White Soldiers Chart Pattern?

The reliability and implications of the Three White Soldiers pattern vary across different timeframes:

Daily Chart

The daily timeframe is generally considered optimal for this pattern:

- Provides a balanced view of market sentiment

- Filters out intraday noise

- Allows sufficient time for pattern confirmation

- Typically has higher trading volume, increasing reliability

- Offers practical entry and exit timing for most traders

Weekly Chart

Three White Soldiers on weekly charts can signal powerful, long-term trend changes:

- Suggests a major shift in market sentiment

- Often precedes substantial moves

- Provides opportunities for position trading

- Requires wider stops but may offer larger rewards

- Less frequent but more reliable when they occur

4-Hour Chart

This intermediate timeframe balances signal frequency with reliability:

- Good for swing trading opportunities

- Offers more frequent signals than daily charts

- Maintains reasonable reliability compared to shorter timeframes

- Useful for timing entries within larger trends

- Popular among active traders

Hourly and Below

Shorter timeframes produce more frequent signals but with reduced reliability:

- More prone to false signals

- Better suited for scalping or day trading

- Requires faster decision-making

- Should be confirmed with higher timeframe analysis

- Best used by experienced traders who can quickly analyze and act

What Indicators Can Be Used in Conjunction With the Three White Soldiers Chart Pattern?

Combining the Three White Soldiers pattern with complementary indicators can significantly enhance its predictive power:

Relative Strength Index (RSI)

- Look for bullish divergence coinciding with the pattern

- Confirm the pattern isn’t forming in extremely overbought conditions

- Watch for RSI moving above 50, confirming the trend shift

- Use RSI to gauge the strength of the new bullish momentum

Moving Averages

- The pattern forming above key moving averages (50, 100, 200-day) enhances its bullish significance

- Look for bullish moving average crossovers around the same time

- Use moving averages for trailing stop placement

- Confirm the pattern isn’t facing immediate resistance from a major moving average

MACD (Moving Average Convergence Divergence)

- MACD crossing above the signal line around the time of the pattern provides additional confirmation

- Bullish divergence on MACD strengthens the reversal signal

- Histogram expanding during the pattern suggests building momentum

- Watch for MACD crossing above zero line, confirming the trend change

Volume Indicators

- On Balance Volume (OBV) rising during the pattern confirms buying pressure

- Volume Profile can identify key support levels that align with the pattern

- Chaikin Money Flow turning positive reinforces the bullish signal

- Volume increasing progressively across the three candles is ideal

Bollinger Bands

- The pattern breaking above the middle band suggests strong momentum

- Pattern forming after price has touched or broken below the lower band indicates potential oversold conditions ripe for reversal

- Width expansion during the pattern suggests increased volatility supporting the new trend

Fibonacci Retracement

- The pattern forming near key Fibonacci retracement levels (38.2%, 50%, 61.8%) of the previous downtrend increases its significance

- Use Fibonacci extension levels for profit targets on the emerging uptrend

The Bottom Line

The Three White Soldiers pattern stands as one of technical analysis’s most visually distinctive and psychologically significant bullish reversal signals. Its consecutive sequence of strong bullish candles provides clear evidence of persistent buying pressure and shifting market sentiment, often marking the beginning of substantive upward price movement.

However, like all technical patterns, Three White Soldiers should not be traded in isolation. Its effectiveness is maximized when confirmed by complementary indicators, volume analysis, and broader market context. By understanding its limitations and implementing strategies to enhance its reliability, traders can better leverage this powerful pattern in their trading arsenal.

The pattern’s applicability across various assets and timeframes makes it a versatile tool for different trading styles, from day trading to position trading. By adapting your approach to the specific market and timeframe, you can optimize the pattern’s predictive value.

Remember that successful trading demands more than pattern recognition alone. Proper risk management, position sizing, and disciplined execution remain paramount. Even the most reliable patterns occasionally fail, which is why protective stops and predetermined exit strategies are essential components of any trading plan.

With practice and experience, traders can develop the discernment needed to distinguish high-probability Three White Soldiers setups from less reliable formations, potentially unlocking consistent trading opportunities in various market conditions.

Trade on the Go. Anywhere, Anytime

In today’s fast-paced financial markets, the ability to spot and act on trading opportunities like the Three White Soldiers pattern shouldn’t be limited to when you’re at your desk. Modern trading platforms offer sophisticated mobile applications that put professional-grade charting tools and execution capabilities literally at your fingertips.

With mobile trading apps, you can:

- Set alerts for potential Three White Soldiers formations across multiple assets

- Analyze patterns with technical indicators on the go

- Execute trades promptly when opportunities arise

- Monitor open positions and adjust stops or targets as needed

- Stay informed with real-time market news and updates

Many platforms offer seamless synchronization between desktop and mobile interfaces, ensuring you have consistent access to your watchlists, alerts, and analysis regardless of where you are. This continuity is invaluable for pattern traders who understand that optimal entry timing can significantly impact trading results.

The combination of powerful pattern recognition skills and mobile trading capabilities creates a potent advantage in today’s markets. Whether you’re a day trader capturing short-term moves or a position trader looking for major trend reversals, having the ability to identify and trade Three White Soldiers patterns anywhere, anytime can be a game-changer for your trading performance.

Remember that while mobile trading offers convenience, it’s still essential to maintain the same disciplined approach you would when trading from your primary workstation. Prepare your trading plan beforehand, set clear risk parameters, and avoid making impulsive decisions simply because the market is always accessible.

By mastering the Three White Soldiers pattern and leveraging modern trading technology, you can enhance your ability to capitalize on some of the market’s most powerful reversal signals, potentially improving your overall trading results in the process.